Buying your dream home is a major step, and it's important to protect your investment from unforeseen challenges. This is where title insurance comes in. It provides monetary protection against encumbrances on the property that could impact your ownership.

A title search uncovers any existing issues with the ownership. If certain issues are discovered, title insurance can help resolve the expenses associated with fixing them.

This insurance is typically necessary by lenders and provides peace of mind that your real estate investment is protected.

Unveiling Title Insurance Costs: A Comprehensive Guide

Purchasing a home is a major financial commitment, and understanding all the associated costs is crucial. One often overlooked expense is title insurance, which protects you from future claims against your property. Despite it might seem like an added expense, title insurance provides invaluable peace of mind. This comprehensive guide will delve into the various factors influencing title insurance costs and empower you to make informed choices about this essential coverage.

- We shall explore the key components that contribute to your title insurance premium.

- Discover how property address impacts the cost of coverage.

- Comprehend the role of the property's assessment in determining your premium.

By understanding these factors, you can make a well-informed selection and ensure that you have adequate protection for your valuable asset.

Exploring Title Insurance Safeguarding Your Property Rights

Purchasing a home is a major investment, and protecting your ownership rights is paramount. This is where title insurance comes into play. Title insurance provides financial security against unforeseen issues that could impact your property's title.

A title search, conducted by a title company, carefully reviews public records to uncover any previous encumbrances on the real estate. If any issues are discovered, title insurance can compensate for financial expenses. This peace of mind allows you to enjoy your ownership without the constant worry of potential disputes to your title.

Coverage Titles Explained: Essential Concepts and Benefits

Navigating the world of insurance can feel overwhelming, particularly when dealing with unfamiliar terms like "title". An insurance title indicates a specific category of coverage provided. Understanding these titles is vital for identifying the right policy to fulfill your specific needs.

- Multiple insurance titles cover a variety of possible risks, from assets damage to legal obligation.

- Knowing the distinct features of each title allows you to make an informed decision about how much coverage is necessary for your circumstances.

- By investigating these key concepts, you can empower yourself to move through the insurance landscape with confidence.

Finally, grasping insurance titles is a critical step in achieving the protection you need.

What Is the Difference Between Title and Homeowner's Insurance

When purchasing a home, it's crucial to understand the distinction between title insurance and homeowner's insurance. Although both provide financial protection, they safeguard against separate risks. Title insurance safeguards your ownership rights by protecting against claims of unknown liens on the property. Homeowner's insurance, on the other hand, covers harm to your home and belongings from events such as fire, theft, or natural events.

- Visualize title insurance as a one-time fee that ensures clear ownership.

- Homeowners' insurance is an annual plan that provides ongoing protection.

By recognizing the differences between these two types of insurance, you can make informed decisions to protect your property effectively.

Understanding the World of Title Insurance: Essential Tips

Purchasing a property is a significant investment, and ensuring a clear and unencumbered title is paramount. Property insurance provides protection against unforeseen problems that may arise related to your ownership. more info Let's delve into some key tips for navigating the complexities of title insurance.

- Begin by carefully reviewing the coverage provided by your provider. Ensure you understand the extent of the guarantees offered.

- Next, it's consult recommendations from reputable agents. Their expertise can be invaluable in guiding you through the selection.

- Furthermore, be vigilant by monitoring any changes related to your title throughout the transaction.

With these tips, you can navigate the world of title insurance with certainty, safeguarding your property for years to come.

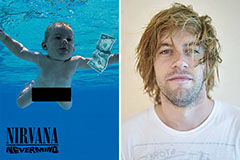

Spencer Elden Then & Now!

Spencer Elden Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now!